Notes

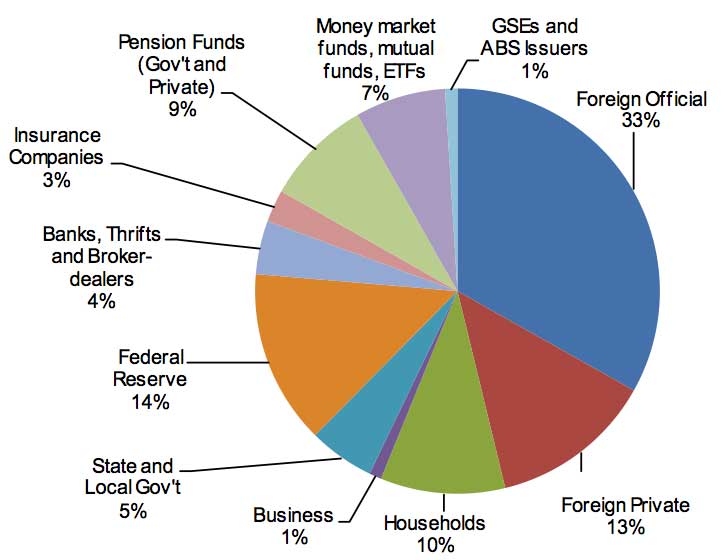

Chart Showing Owners of US Treasury Debt

Though unlikely, it’s still interesting to see who would need to be paid first in order to avoid a technical default on US debt.

The Big Picture blog has this great chart from Société Générale showing who holds US Treasury debt (see chart below).

Additionally, here is another source of debt breakdown by total amount held and percentage of total U.S. debt, according to Business Insider:

Hong Kong: $121.9 billion (0.9 percent)

Caribbean banking centers: $148.3 (1 percent)

Taiwan: $153.4 billion (1.1 percent)

Brazil: $211.4 billion (1.5 percent)

Oil exporting countries: $229.8 billion (1.6 percent)

Mutual funds: $300.5 billion (2 percent)

Commercial banks: $301.8 billion (2.1 percent)

State, local and federal retirement funds: $320.9 billion (2.2 percent)

Money market mutual funds: $337.7 billion (2.4 percent)

United Kingdom: $346.5 billion (2.4 percent)

Private pension funds: $504.7 billion (3.5 percent)

State and local governments: $506.1 billion (3.5 percent)

Japan: $912.4 billion (6.4 percent)

U.S. households: $959.4 billion (6.6 percent)

China: $1.16 trillion (8 percent)

The U.S. Treasury: $1.63 trillion (11.3 percent)

Social Security trust fund: $2.67 trillion (19 percent)

Chart Source: Who Owns Treasury Debt?

14 years ago

Other Notes

Discovering the Enigmatic Runaway Black Hole and its Trail of Stars: A Cosmic Marvel Unveiled

3 years ago

ReadDefying Logic: When Gravity Takes a Break and Hills Play Tricks on You!

3 years ago

ReadIndieWeb: A Humane Alternative to Social Media Giants

6 years ago

ReadMeet Strong Towns

7 years ago

Read